The Multi-Layered Attack on a Wealth Tax

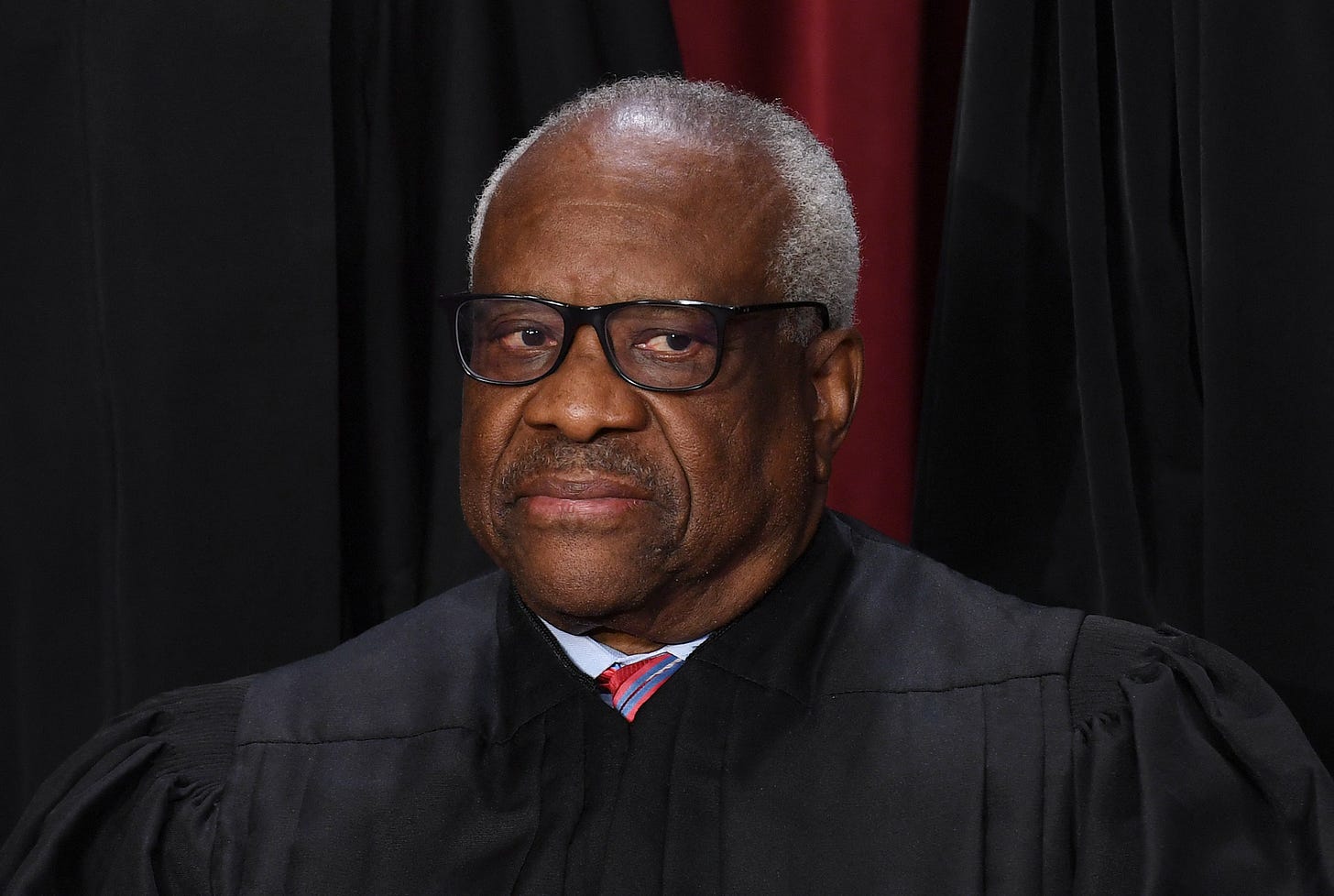

As Clarence Thomas admits that he did take lavish gifts from billionaire Harlan Crow and failed to disclose thousands of dollars, it becomes easier to connect the dots on the rich buying influence.

A new financial disclosure from Clarence Thomas was made public Thursday, in which the Supreme Court Justice admitted for the first time that he received three private jet trips last year from Harlan Crow, a man described as the “largest landlord in the United States” by Forbes magazine. In his previous disclosure, Thomas also conveniently forgot to disclose a real estate deal with Crow, whereby Thomas sold him two vacant lots and the house where Thomas’ mother is currently living.

Justice Thomas, along with Justice Alito, received an extension on the filing deadline of the forms, after it surfaced that both men had failed to disclose expensive luxury gifts from billionaire donors, drawing substantial ethical scrutiny. Thomas now claims in his annual disclosure form that he “inadvertently failed to realize” that the real estate deal with Harlan Crow needed to be publicly disclosed.

Keep reading with a 7-day free trial

Subscribe to SHERO to keep reading this post and get 7 days of free access to the full post archives.